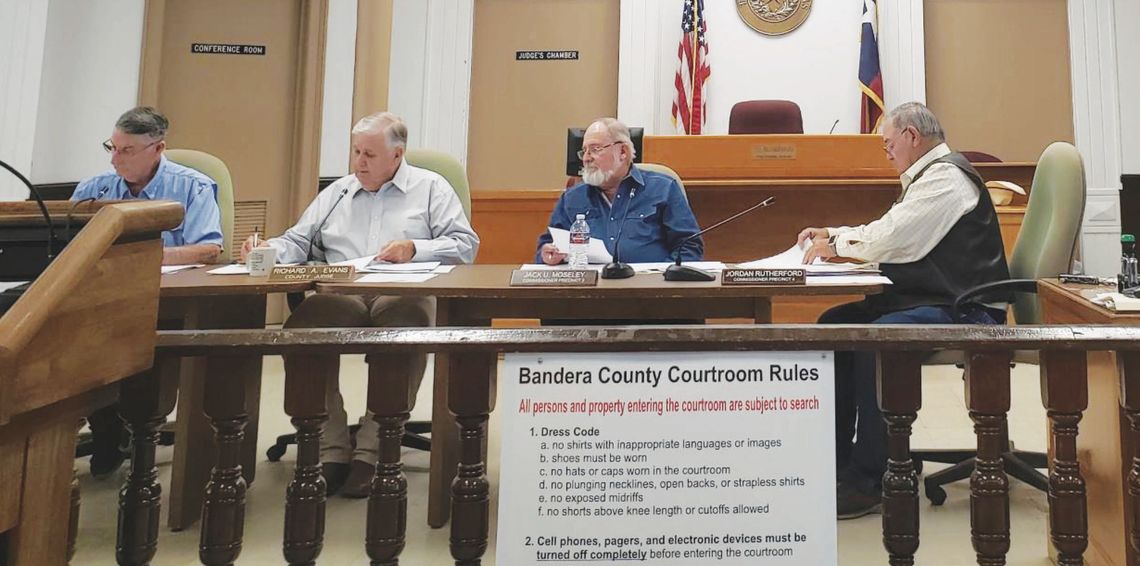

Bandera County Commissioners approved the tax rates for 2025, with all commissioners voting in favor on Sept 26 except for Commissioner Greg Grothues, who was absent.

The adopted rates include a Maintenance and Operation tax rate of 0.4610, a Road and Bridge tax rate of 0.0400, and an Interest and Sinking tax rate of 0.0185.

Bandera County Judge Richard Evans inquired whether the Interest and Sinking rate would be eliminated next year, and County Auditor Darryl Sadler confirmed that it would conclude in 2027.

Following this discussion, the court unanimously ratified the property tax increase reflected in the 2024-25 budget.

According to county officials, the new budget will raise an additional $2,110,744 from property taxes compared to last year, representing a 7.63 percent increase.

Additionally, property tax revenue from new properties added to the tax roll this year is projected to be $441,344.

Before the vote, county resident Denise Gober addressed the Court, expressing concerns about the impact of the tax increase.

“The tax increase for the average property in Bandera County is going to be about 20 percent,” Gober said. “For some, this could be significant.”

While she noted that her own exemptions mitigate the impact, she emphasized the burden it could pose for newcomers to the area.

Gober also suggested exploring options for reducing expenses, asking about the surplus funds from the 2024 budget.

“Where does that go? Does that just go away? Have you ever considered doing zero-based budgeting?” she inquired.

Judge Evans responded, “We are decreasing the tax rate. For the third year in a row, we’ve decreased the tax rate 23 percent. There’s a limit to what we can tax, and we’re trying to be good stewards of the money.”

He added that any remaining funds would be allocated to the Funds Balance.

The full county budget, filed by the County Clerk on September 30, can be accessed at banderacounty.org/page/auditor. budgets.

.png)